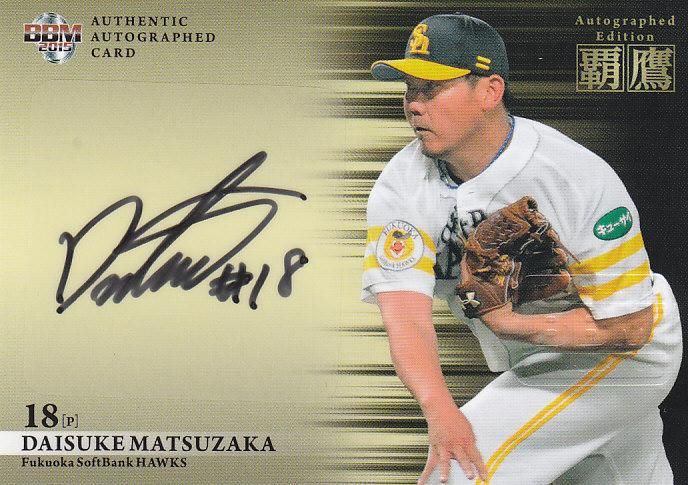

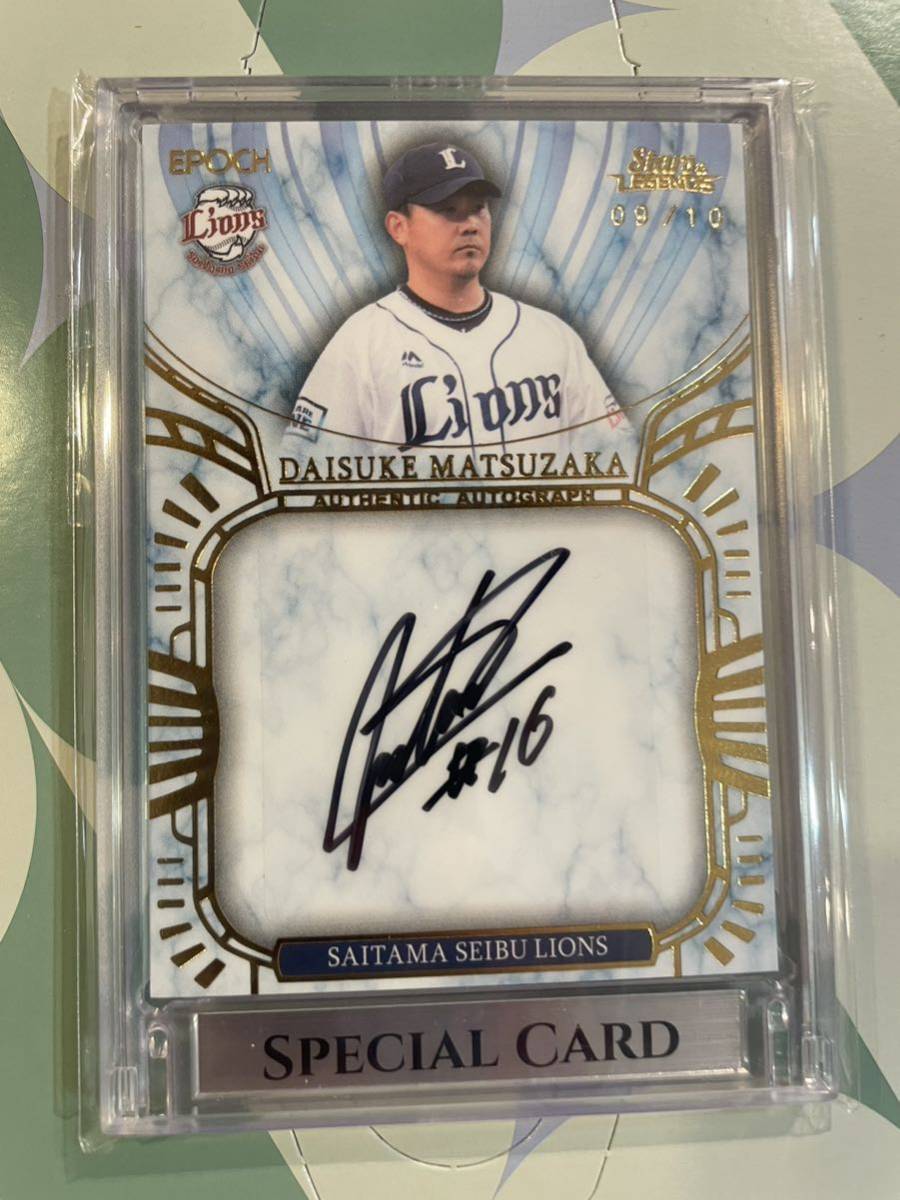

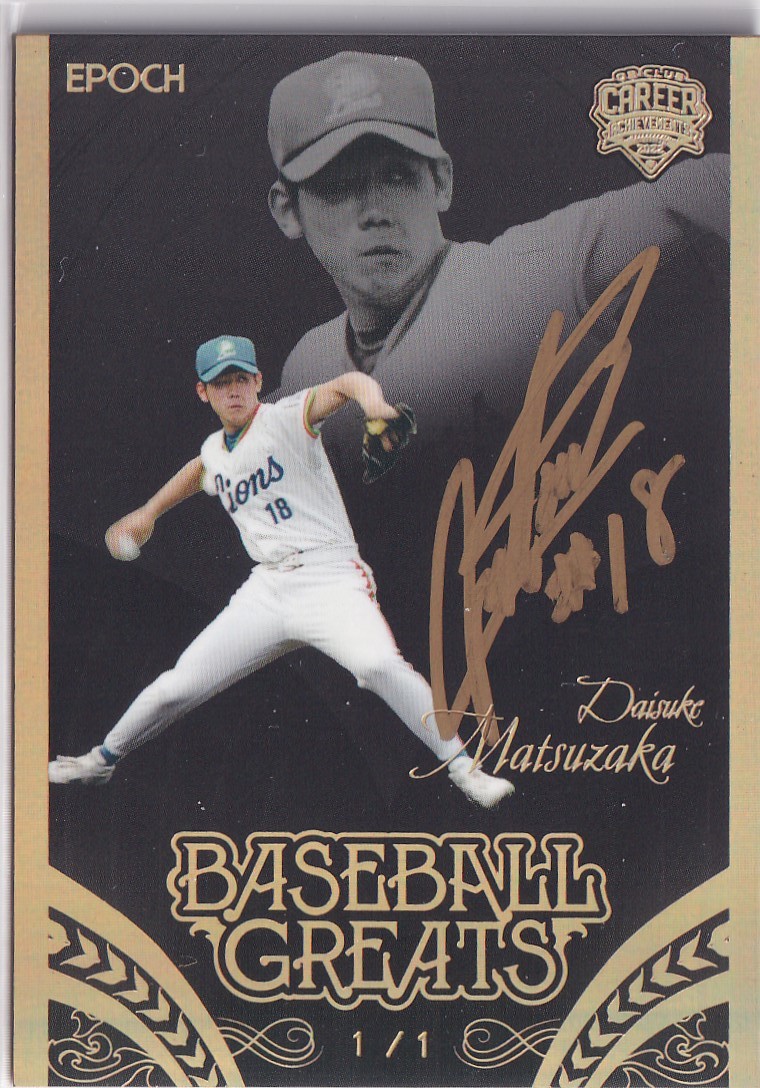

2015BBM松坂大輔20枚限定サイン

(税込) 送料込み

商品の説明

商品に問題があった場合を除き購入後のキャンセル及び返品は固くお断り致します。またこの商品は値引き交渉不可にてお願いいたします。

商品の情報

| カテゴリー | おもちゃ・ホビー・グッズ > トレーディングカード > その他 |

|---|---|

| 商品の色を | ホワイト系 / ブラック系 / ブラウン系 |

| 商品の状態 | 未使用に近い |

市場価格10万円超え!!松坂大輔投手のボールサインカード,松坂大輔 サイン会 (宮崎キャンプ),松坂大輔 WBC 好投,松坂大輔の腕を引っ張った人は中日ファンではなく転売屋?ダルビッシュも故障した経験が過去に!? - 事故ニュース,【松坂大輔が嫌だった打者は〇〇】イチロー初対戦の裏話!仲が良い選手は誰?,西武全盛時期 Daisuke Matsuzaka 松坂大輔 神話般的魔球 Gyroball!?,【これは・・・】大谷翔平「あっイチローさん松井さん松坂さん(帽子取ってペコリ」「あっ上原さん!」【5chまとめ】,【なんやそれ⁉︎】松坂との最後の対決で清原の心が折れた理由 #shorts,【え、負けるん?】佐々木朗希から3点取ってまさかの逆転負けにブチ切れ,2008 MLB 日本開幕ハイライト 松坂インタビュー.mpg,4/5/07: Dice-K's MLB Debut,1999 松坂大輔 5 衝撃の155kmデビュー 全投球 プロ初登板,2004雅典奧運松坂大輔vs古巴7K,ソフトバンクホークス 松坂大輔 自主トレ公開 20150129,【松坂大輔】奪三振100連発(西武時代),松坂大輔・上原浩治、野球人生初のキャッチボールでトーク展開 『スカパー!プロ野球セット』新CM,【プロ野球パ】松坂、制球に苦しみ3回2失点とパッとせず・・・ 2015/03/10 H2-2G,2005年5月18日 阪神VS西武 松坂13奪三振,【感謝感激😭】イチローさん選んでくれてありがとうございます!選ばれないんじゃないかとドキドキしました【イチローさんが選ぶ'06\u0026'09WBC日本代表ベストオーダーアンサー動画】,2023.03.27.松坂大輔,【第11回】久しぶりの期間限定パックから松坂大輔選手出るのか? 【プロ野球バーサス】#171

オイルペイント 2015BBM松坂大輔20枚限定サイン | www

オイルペイント 2015BBM松坂大輔20枚限定サイン | www

2015BBM松坂大輔20枚限定サイン その他 メーカー販売 teegro.gob.mx

オイルペイント 2015BBM松坂大輔20枚限定サイン | www

オイルペイント 2015BBM松坂大輔20枚限定サイン | www

オイルペイント 2015BBM松坂大輔20枚限定サイン | www

2015BBM松坂大輔200枚限定ジャージカード - メルカリ

オイルペイント 2015BBM松坂大輔20枚限定サイン | www

ルーキー伝説 20枚限定 BBM 2021 吉田正尚 直筆サインカード

最新コレックション 松坂大輔直筆サイン&パッチカード9枚限定ラスト

松坂大輔25枚限定サインカード www.pibid.org

メーカー包装済】 BBM2021 2nd 25枚限定クロスブランド版直筆サイン

大特価放出! 2015BBM GENESIS 藤浪晋太郎 直筆サイン&BIGパッチカード

松坂大輔ジャージカード200枚限定 | www.mxfactory.fr

2015BBM松坂大輔20枚限定サイン その他 メーカー販売 teegro.gob.mx

199枚限定 松坂大輔 カード トレーディングカード その他 www

オープニング 大放出セール 松坂大輔直筆サインカード50枚限定 その他

2022 BBM ヤクルト ヒストリー 村上宗隆 20枚限定 直筆サイン カード

松坂大輔ジャージカード200枚限定 | www.mxfactory.fr

2015BBM松坂大輔20枚限定サイン その他 在庫限定 2015BBM松坂大輔20枚

難あり松坂大輔パッチ直筆サインRCカード20枚限定 tarbiyahislamiyah.id

2023年最新】松坂大輔 サインの人気アイテム - メルカリ

2015BBM松坂大輔20枚限定サイン その他 メーカー販売 teegro.gob.mx

難あり松坂大輔パッチ直筆サインRCカード20枚限定 www.stiedewantara.ac.id

オープニング 大放出セール 松坂大輔直筆サインカード50枚限定 その他

オイルペイント 2015BBM松坂大輔20枚限定サイン | www

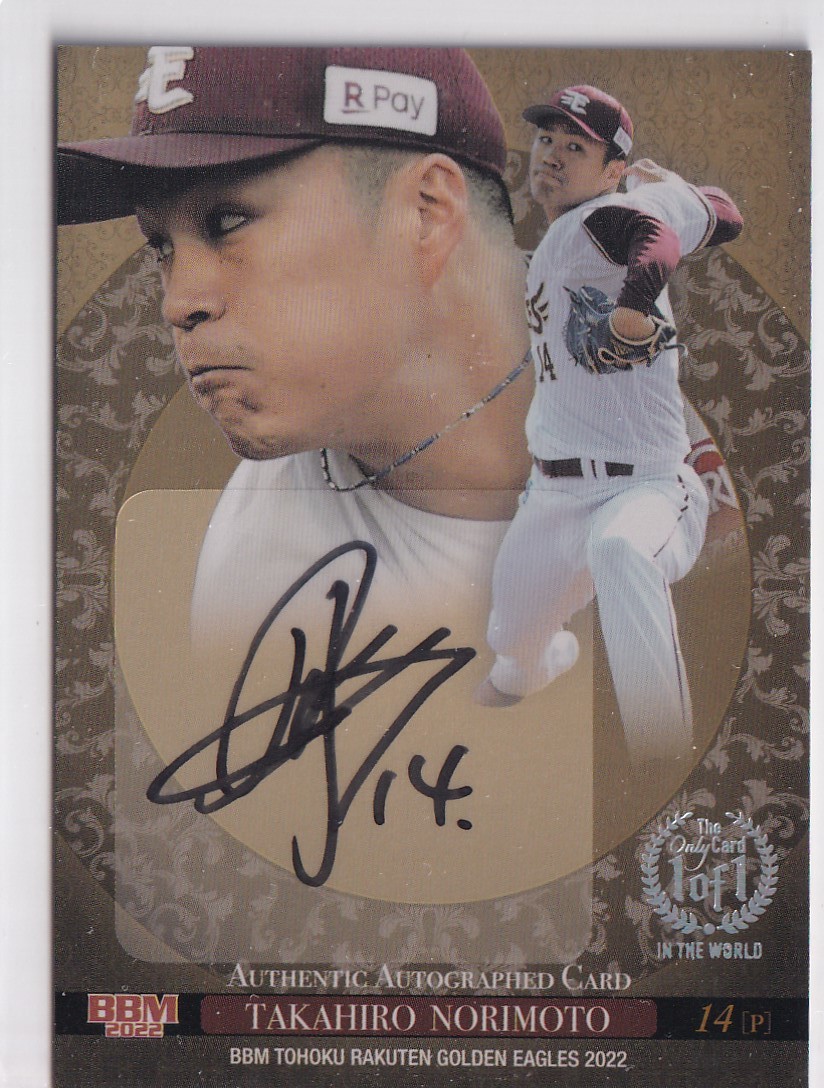

独特な 【送料無料】 2022 BBM 則本昂大 楽天イーグルス インサート版

数量限定価格!! 金本知憲 15 広島カープ BBM MASTER of 阪神タイガース

スティーブ ナッシュ Panini Signatures 直筆サイン 10枚限定 その他

松坂大輔ジャージカード200枚限定 | www.mxfactory.fr

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています